TriNet Expense was the first expense management solution to support integrating with NetSuite. Currently there are two export methods available to TriNet Expense users when submitting expense reports to NetSuite:

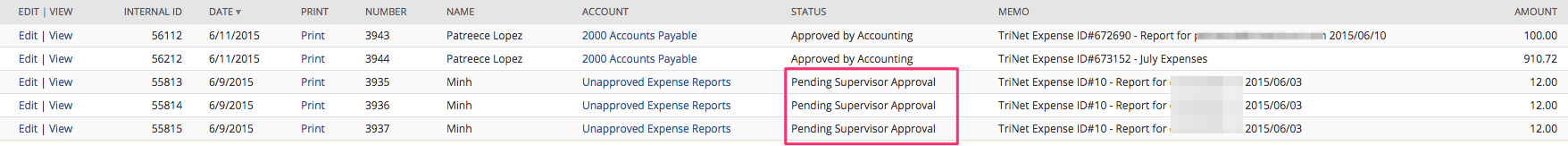

Method One: Submit to NetSuite Employee Center as an unapproved report, leveraging the standard approval process within NetSuite.

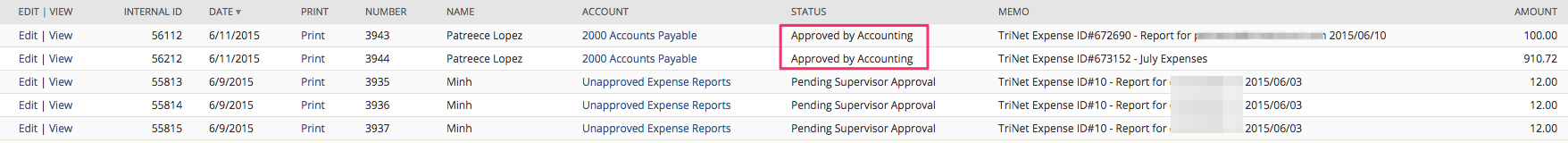

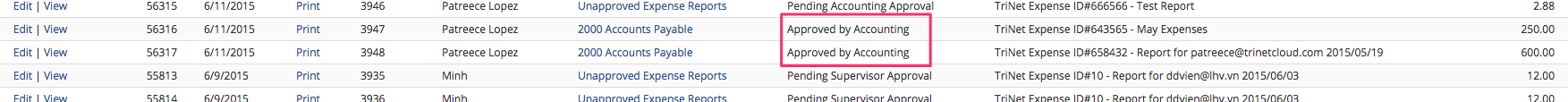

Method Two: Submit to NetSuite as an approved expense report (directly recording to the NetSuite Accounts Payable), utilizing TriNet Expense built in approval and policy enforcement process. This process supports sending the report individually (batches coming soon), and requires the final TriNet Expense approver to have administrative rights within NetSuite. You can also select where you want the expenses recorded based on the reimbursable state of the expenses. Non-Reimbursable can be entered into the Account Payable as a Bill to the Vendor (usually the credit card). Reimbursable expenses can be recorded to Employee Center. User can also choose to send both non-reimbursable and reimbursable expenses directly into Employee Center.

Either method is determined by the report status in TriNet Expense and if the NetSuite credentials have been set up. If the report is in an unsubmitted state within TriNet Expense and sent to NetSuite , it will leverage Method One. If the report is in an approved state within TriNet Expense it will leverage Method Two. Both methods are premium features and require a license.

TriNet Expense also supports Multi-Currency and Subsidiaries from NetSuite.

Submitting An Expense Report From Report View

Expense reports can be exported to NetSuite by clicking the Submit button directly within an expense report (the NetSuite option must be selected from the drop-down list) Additionally, the report can be submitted via our iPhone and Android mobile apps using Method One.

In a few seconds, TriNet Expense will export the expense report to NetSuite. Using Method One, users will find a new expense report created in NetSuite with all their expenses and digital receipts. The report is automatically submitted for approval within NetSuite. Using Method Two, the report is considered approved and already recorded to accounts payable account. The report will contain all the expense line items and receipts that were in the TriNet Expense report.

View Submitting An Unapproved Expense Report To NetSuite. This will be sent to NetSuite As Pending Approval. You NetSuite To Approve This Report.

View Submitting An Approved Expense Report To NetSuite This Will Be Sent To NetSuite As An Approved Report.

View Submitting All Expenses To Employee Center's Expense Report After The Report Is Approved

View Submitting Expenses Based On The Reimbursable State. Non-Reimbursable Expenses Are Recorded As A Bill. Reimbursable Expenses Are Recorded As An Expense Report In Employee Center

Selecting NetSuite Clients Within TriNet Expense

Users can select from the list of customers stored in NetSuite and add them to each line item of their expense report. Customer data is export back to Netsuite and will be displayed within each expense row. To do so, chose the expense (either from the Active Expense page or from within the Expense Report) and select the Show Client ID option in the Client ID field. More details on adding NetSuite customers can be found here.